In fact, in 2024 alone, Americans aged 60 and older lost nearly

$4.8 billion

to scams, a 43% increase from the previous year, according to the FBI.

Quick Summary: Common Scams Targeting Seniors

- Sweepstakes and Lottery scams

- Reverse mortgage scams

- Romance scams

- Tech support scams

- Grandparent scams

- Robocalls and phone scams

- Government imposter scams

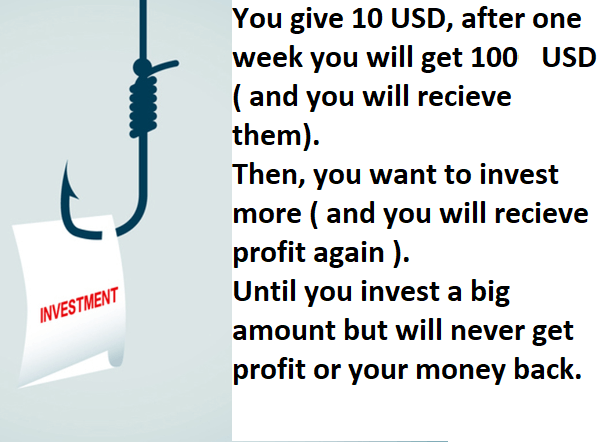

- Investment scams

- Home repair scams

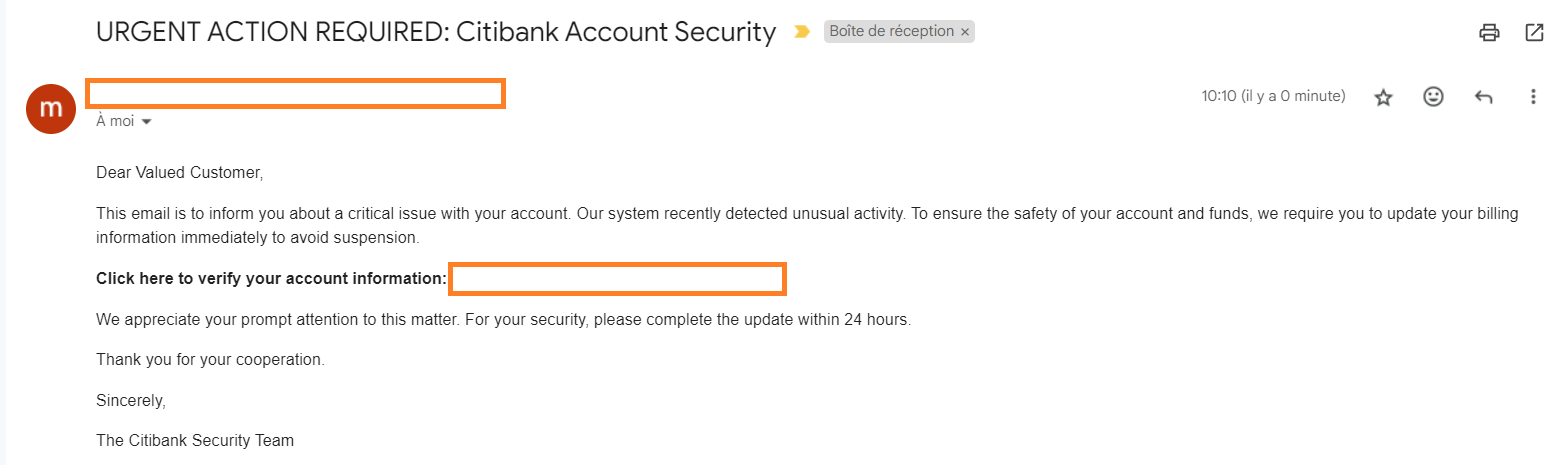

- Phishing and email scams

Tip: If something feels urgent, emotional, or too good to be true, it’s likely a scam.

Here is a guide that will help you detect the different scams that may target you and what you can do about them :

1. Sweepstakes and Lottery Scams

If you get a phone call, email, or letter claiming you’ve won a prize or lottery, be cautious. Even if it sounds exciting, it’s often a trick.

These scams usually ask you to pay a fee or provide your bank details before releasing your “winnings”. Some may even send a fake check that later bounces after you’ve already sent your own money.

If anyone asks for money to claim a prize, it’s a scam. Real lotteries never require payment to receive winnings.

2. Reverse Mortgage Scams

A reverse mortgage can be a legal way to get cash from your home equity. But scammers may trick you into handing over your home’s title or signing false documents.

They may promise monthly payments but never deliver, or sell your house without your knowledge. Always check the identity of the person or company before signing anything.

If something feels suspicious, stop and seek advice from a trusted financial advisor or call HUD at 1-800-347-3735.

3. Senior Romance Scams

It is very easy to set up profiles on dating sites for seniors if you are looking for a partner or companionship. However, you always need to be careful on these sites as they provide a ready opportunity to romance scammers.

Many create fake profiles on senior dating sites to trick people into emotional and financial traps.

The scammer usually starts with a friendly message. Things move quickly and leads to love profess within days, talk about marriage, or suggest meeting soon. But then, a crisis appears. They need money for a medical emergency, travel costs, or to release a “gift” stuck in customs.

Often, these scammers claim to be in another country and say they can’t video chat or meet in person. Every excuse sounds urgent, emotional and designed to make you feel responsible !

In some cases, these scammers involve victims in money laundering schemes, which could get you involved in criminal activity.

Even if someone seems sincere, be cautious if you’ve never met in person and especially if they ask for money.

4. Tech Support Scams

If you see a pop-up on your computer that says your device is infected and tells you to click a link or call a number, stop right there. It’s 99% a scam !

These pop-ups often lead you to download harmful software (malware) that lets scammers take control of your device and steal your personal information.

5. Grandparent Scams

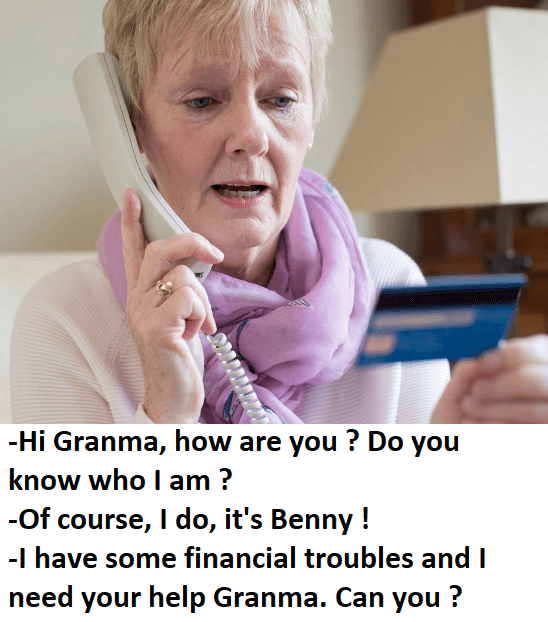

These are very common and you will usually get a call saying, ‘’Hello Grandma or Grandpa, do you know who is calling?” When you guess and take the name of your grandchild, you will be asked for money for some devious but apparently serious reason (rent payment, food bills, legal fine, car repair money, etc.)

This scam often starts with a call that says something like, “Hi Grandma, do you know who this is?” If you guess the name of a grandchild, the caller pretends to be her/him and says he/she’s in trouble … been in an accident, arrested, or need emergency money.

You’ll be asked to send funds quickly, often through Western Union or MoneyGram. The scammer may also beg you not to tell anyone especially “his” parents because they’ll be mad.

These stories are made to sound urgent and emotional like in romance scams. But once the money is sent, the caller disappears, and you may never hear from him/her again.

If you ever receive a call like this, take a moment. Ask a question only your real grandchild would know not something that could be found on social media.

It’s very sad that people do that! It’s even worse when you are the victim. I have been there as well, and, A P T R E C O UP, a non profit organization set up by people who have been victims came to my rescue.

We’re truly sorry to hear that you’ve been through something like this, Kim. It’s great that you get some support from that organisation. Can you share it’s contact that other people can find it here ?

Thanks

Stay safe